My two best friends pulled out their shiny, brand-new credit cards. “They’re so pretty. I love the silver overlay.” They gushed. I nodded my head in agreement. That card was like the tattooed bad-boy at the bar I knew would be bad for me. I wanted him.

I went home the next day and immediately signed up for a credit card. It was surprisingly simple; with basically no credit to speak of I was approved with a hefty credit line and my shiny new card was in hand within a week.

“It’s just for emergencies, and only if I really need it.” I told myself with a confident nod. Of course it’s just for emergencies. Of course.

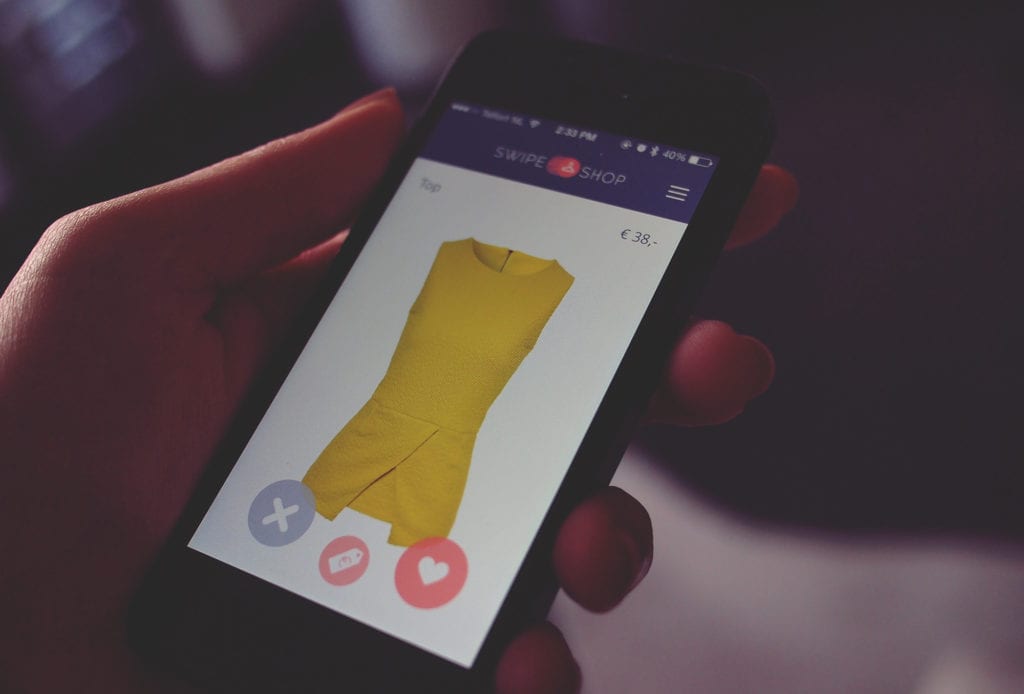

Then, I started using the card. My affair with the sexy, dangerous-looking tattooed man had begun. Swiping that card was a head rush. My heart was pounding and my palms were sweaty. Swipe, swipe, swipe. I relished in these moments, swiping away, signing my name and having my checking account balance remain miraculously full. Plus, my card offered me cash back for things I was already spending money on. I HAVE to go to the movies. It’s for the cash back! My relationship with the man in the bar was becoming an unhealthy one. I NEEDED him. I loved him. Being with him felt so good. Swipe, swipe, swipe.

That is essentially when everything went to shit. It didn’t feel like spending real money, so it was fine. I started charging new clothes, concerts, meals out, ridiculous cat toys, etc.

Then, the emergencies I’d originally planned to get the card for started happening. I moved to Philadelphia and my car insurance went way up. I was in a car accident that was my fault and my deductible was $500. I was then hospitalized and my hospital bill was over a grand.

My credit card and I hit our 1-year anniversary. One year in and I was only a few more swipes away from my credit limit. Even worse, my 1 year of 0% interest grace period had reached its end. My interest rate leaped to 22%. What. The. Fuck. Did. I. Just. Do?!

I was the perfect debt-ridden disaster. I was the reason that credit card companies target new college graduates. I’d fallen into the trap of more cash back points and an addiction to swiping seemingly without consequence. I made the fiscally irresponsible decision that many of us make in our early twenties. We are broke now, but we are certain our careers are lucrative and we will be able to pay off the card easy breezy. Right?

Wrong.

I found out the hard way how addictive and toxic these kinds of relationships with a piece of plastic can be. You have no idea if your job is going to be lucrative or not. You owe it to your present self to live within your means. You owe it to your future self to have money saved and not get into high-interest debt. It will affect your credit score. It will affect your future ability to get low interest rates on a car payment or a mortgage. Plus, credit card minimum payments suck you into a debt tornado that never ends.

My exact credit card balance at this moment is $7,861.14. I regret it immensely, but it was a lesson I am glad I learned early on. The good new is it’s not too late to end this relationship in its tracks. Credit card debt, we are never ever ever ever getting back together.

To keep myself from drowning, I sought the financial advice of those much smarter and fiscally responsible than I. Here are the takeaways:

1. Refinance: If you’re in a crap load of debt, see if you can refinance a portion of it to a 0% interest rate card. It can buy you some time so you’re not hemorrhaging in paying interest. But, you need to pay THAT card off before the grace period ends with a sound financial plan.

2. Emergency Fund: Have an emergency fund of 1 month’s living expenses saved to start because a credit card is not for emergencies, an emergency fund is for emergencies.

3. Get Dat Debt Down: Throw most of your spare money at the debt monster until it is vanquished.

4. Save Save Save: Once the card is paid off, the debt monster is slain, and the beautiful princess of financial security is saved, focus on getting your savings up to 3 months of living expenses. Once you have 3 months of living expenses in your reserve, sign up for your company’s 401(k). It’s healthy to start out making around a 6-8% contribution of your salary, and if your company matches you want to contribute at least that amount.

5. Six Months of Living Expenses Required: Next, save 6 months living expenses. 6 months of living expenses can get you through a job loss or unexpected severe illness. It is the golden ticket to financial freedom and stability.

6. Invest: After that, you’ll be free to start investing money in stocks, real estate, gold, ridiculous cat toys, etc.

7. Investing vs. Debt: Investing is the yin to debt’s yang: Interest on your investment is a great thing- when your money makes money it’s like possessing the Elder Wand. Interest on your debt is an awful thing – the Voldemort to your financial security.

Please note that I am only on steps 1 & 2 of this 7-step program. I am humble beginner on the road to financial security. I learned my lesson. I am ready to move forward.

Some people are financial wizards with the wisdom and patience of Dumbledore. I am not one of those people. I’m like the Neville Longbottom of finances. Please use my failed plastic relationship as a tale of caution. Credit card swipes are real money even if it doesn’t feel like real money. Your accrued interest can destroy you. Budgeting, saving, and fiscal responsibility are way less sexy than the tattooed bad-boy at the bar, but the freedom and peace of mind they enable you are truly priceless.